Bitcoin Halving

One of the most pivotal events in the Bitcoin blockchain infrastructure is the halving process, which cuts the mining reward rate by 50%. This adjustment aims to stabilize the cryptocurrency’s function as a store of value, given Bitcoin’s fixed maximum supply of 21 million units.

With over 19 million Bitcoins already mined, only about 2 million Bitcoins remain. Therefore, the reward for miners is periodically reduced in an event known as Bitcoin halving.

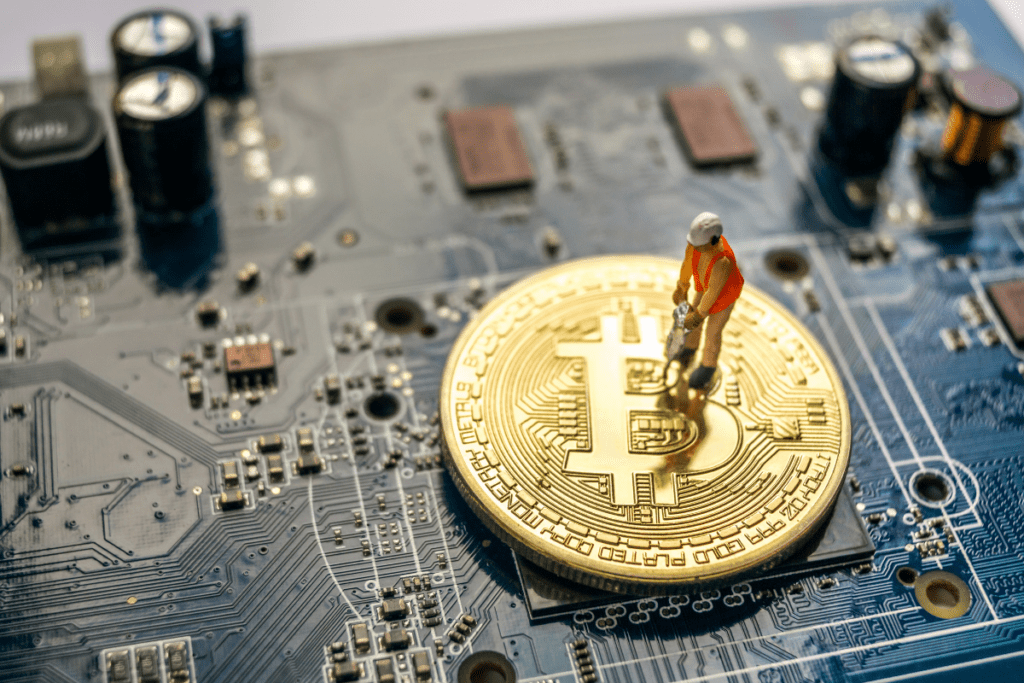

Understanding BTC halving benefits from a basic knowledge of crypto mining, the mechanism through which new Bitcoins are generated. The Bitcoin network operates without the need for central authority, with miners—computers processing transactions—playing a crucial role. These miners validate transactions and maintain network security, earning BTC rewards in return.

The BTC halving, a key event in the crypto calendar, halves the mining reward to limit the influx of new digital assets into the network.

Cryptocurrencies like Bitcoin, which utilize the Proof-of-Work (PoW) algorithm, are minted by miners using specialized computers to solve complex mathematical problems, thus introducing new coins and earning rewards. Bitcoin transactions are grouped into “blocks,” which link together to form the blockchain. Miners vie to discover the next block and claim their rewards.

A Bitcoin halving takes place every 210,000 blocks mined, which roughly translates to every four years. This periodic halving reduces miners’ rewards and is integral to Bitcoin’s design as an alternative to inflation-prone traditional currencies like the US dollar.

Cryptocurrency advocates argue that, unlike traditional currencies, Bitcoin’s value is expected to appreciate over time due to its limited supply of 21 million units. This cap ensures Bitcoin remains immune to the inflation that can erode traditional money’s purchasing power. Satoshi Nakamoto, Bitcoin’s creator, introduced the halving mechanism to maintain the currency’s limited supply.

The impact of the Bitcoin halvin on the crypto world

The Bitcoin halving has catalyzed significant shifts in the cryptocurrency landscape, altering the supply and demand dynamics of Bitcoin.

The decrease in block rewards leads to a slower pace in the issuance of new Bitcoins. Consequently, with the reduction in supply, the potential value of existing Bitcoins tends to rise.

Bitcoin halving and its impact on mining revenues

When the block reward is halved, miners may find that their operations are no longer profitable due to costs like electricity and hardware. If the price of Bitcoin does not rise to offset this reduction, some miners may cease their mining activities. This can lead to a decrease in the network’s processing power.

The Bitcoin halving results in a 50% reduction in mining revenues, which supports the healthy and sustainable growth of the blockchain network. The halving slows down the rate of BTC production, ensuring that the supply of Bitcoin remains limited. Consequently, the inflation rate of Bitcoin decreases after a halving event.

Comparison of mining revenues before and after the halving

On January 3, 2009, when the first 10,500,000 Bitcoins were introduced into circulation, the mining reward was set at 50 BTC. Below is a table showcasing the past Bitcoin halving dates along with the mining rewards for each halving event.

| Activity | History | Block | Mining Revenue | Total Bitcoin |

| The first Bitcoin | 03.01.2009 | 0 | 50 BTC | 10.500.000 |

| Halving | 28.11.2012 | 210.000 | 25 BTC | 5.250.000 |

| Halving | 09.07.2016 | 420.000 | 12.5 BTC | 2.625.000 |

| Halving | 11.05.2020 | 630.000 | 6.25 BTC | 1.312.500 |

| Halving | April 2024 | 740.000 | 3,125 BTC | 656.250 |

| Halving | 2028 | 850.000 | 1.5625 BTC | 328.125 |

The Bitcoin halving will occur every 210,000 blocks until 2140, the date when all 21 million coins will be in circulation.

Possible scenarios for miners

Bitcoin’s protocol is designed to decrease the amount of BTC awarded to miners for adding a block to the blockchain.

The mining reward is halved every 210,000 blocks, which occurs roughly every 4 years, given that a new block is added to the blockchain approximately every 10 minutes. This reduction in mining rewards is a crucial factor for miners, affecting their profitability, return on investment for hardware, and overall operational costs.

As their revenues decline and the need for more advanced hardware grows, miners may shift their focus to other cryptocurrencies with algorithms similar to Bitcoin’s. Without a significant rise in BTC’s price following a halving, mining may only remain profitable for companies equipped with the necessary technology and financial resources to sustain their operations.

The relationship between Bitcoin halving and market cap

The core principle behind the Bitcoin halving is to reduce the supply. As new Bitcoins are mined via block rewards, the rate at which they can be introduced into circulation is also curtailed.

This approach to reducing supply emulates the scarcity and deflationary characteristics of precious metals, like gold.

As the production of new BTC diminishes over time, the digital currency becomes scarcer. At this juncture, as demand for the digital currency persistently increases, the value of the cryptocurrency tends to rise.

How does the price of Bitcoin change after a halving?

Many analysts believe that following the 2024 Bitcoin halving, the price of Bitcoin is expected to rise due to the supply scare prompted by the reduced reward. The significant price increases observed after previous halvings serve as the primary basis for those who support this view.

Bitcoin halving and market dynamics from a historical perspective

The most fascinating aspect of Bitcoin halving events is their influence on the cryptocurrency’s price. To gain insight into future possibilities, examining the historical Bitcoin halving chart and the evolution of price cycles is beneficial.

The first halving occurred on November 28, 2012, when Bitcoin’s value was approximately $12. Just one year after this halving, Bitcoin’s value soared to nearly $1,000.

During the second halving on July 9, 2016, Bitcoin’s price dropped to $670, but by July 2017, it had climbed to $2,550. Following the most recent halving in May 2020, Bitcoin was trading at $8,787. Then, in November 2021, BTC reached an all-time high of $69,000. These price surges underscore the significance of the question “when is the BTC halving” with each halving period.

Investor strategies for the next Bitcoin halving

The history of Bitcoin’s past halving dates and the price movements during those periods suggest that halvings can present opportunities for investors. However, given the unique dynamics of the cryptocurrency markets, it’s crucial to prepare for BTC halvings and devise varied strategies.

Separate approaches should be adopted for long-term and short-term strategies. In the realm of investment, conducting research, performing analysis, diversifying risks, and being prepared for potential loss and gain scenarios are essential principles to follow when investing in Bitcoin Halvings.

Investors’ preparation processes for halving

Investors can employ diversification in their preparations for Bitcoin halving events. Diversification stands as a core principle of investment strategy, a rule that holds true in the cryptocurrency domain as well. Despite BTC’s prominence, it’s vital to acknowledge the breadth and variety of the crypto market.

A diversified portfolio can lessen the risks tied to the volatility of specific assets. By distributing your investments across various cryptocurrencies and even traditional assets, you can soften the blow of price changes in any single asset. Moreover, while Bitcoin might be the focal point of your crypto portfolio, considering an allocation of your investment to other cryptocurrencies, often called altcoins, could be wise.

The importance of halving for long-term investment

The foreseeable decrease in the supply of new BTC over time enhances Bitcoin’s appeal as an investment option. The combination of Bitcoin’s finite supply and the growing demand may exert upward pressure on its price.

Although past performance is not indicative of future outcomes, analysis of data from previous Bitcoin halving events and related charts suggests that Bitcoin’s price generally experiences an uptick following a halving.

Bitcoin halving and experts’ predictions

Although predicting the exact impact of Bitcoin halving on prices is challenging, many experts formulate their forecasts based on historical trends and market dynamics. A prevalent prediction among experts is that halvings could result in significantly larger price increases than seen in the past, especially as institutional investors enter the market.

What do economists say?

Beyond the price effects of Bitcoin halving, economists also take into account various factors influencing cryptocurrency markets. Developments in Bitcoin ETFs, often highlighted in Bitcoin news, are considered significant in their analyses. The introduction of Bitcoin mutual funds (ETFs) on US stock exchanges stands as a crucial factor that could enhance the likelihood of BTC price increases.

Figures such as Mark Mobius, a renowned figure in global markets, Youwei Yang, the chief economist at crypto mining company Bit Mining, and Matrixport, a well-known financial services firm, predict an increase in Bitcoin’s value following halvings.

Cryptocurrency analysts’ halving predictions

Reflecting a consensus similar to that of economists, cryptocurrency analysts’ predictions also foresee a rise, influenced both by the Bitcoin halving and ETFs.

Analysts point out that the halving event scheduled for April 22, 2024, which will reduce the mining reward for a Bitcoin block from 6.25 BTC to 3.125 BTC, will impact the inflation rate.

Consequently, after the halving, Bitcoin’s annual inflation rate is expected to drop from 1.7% to approximately 0.85%. This will be the first occasion that BTC inflation dips below 1%.